..for Wealth Managers and Private Bankers who wish to maximize value for their clients..

Course on Private Equity

for

Wealth Managers and Private Bankers

Unique Approach

Live classes to share direct experience

Class material made available off-line

Personal coaching (teachers are reachable after class)

Lesson 1

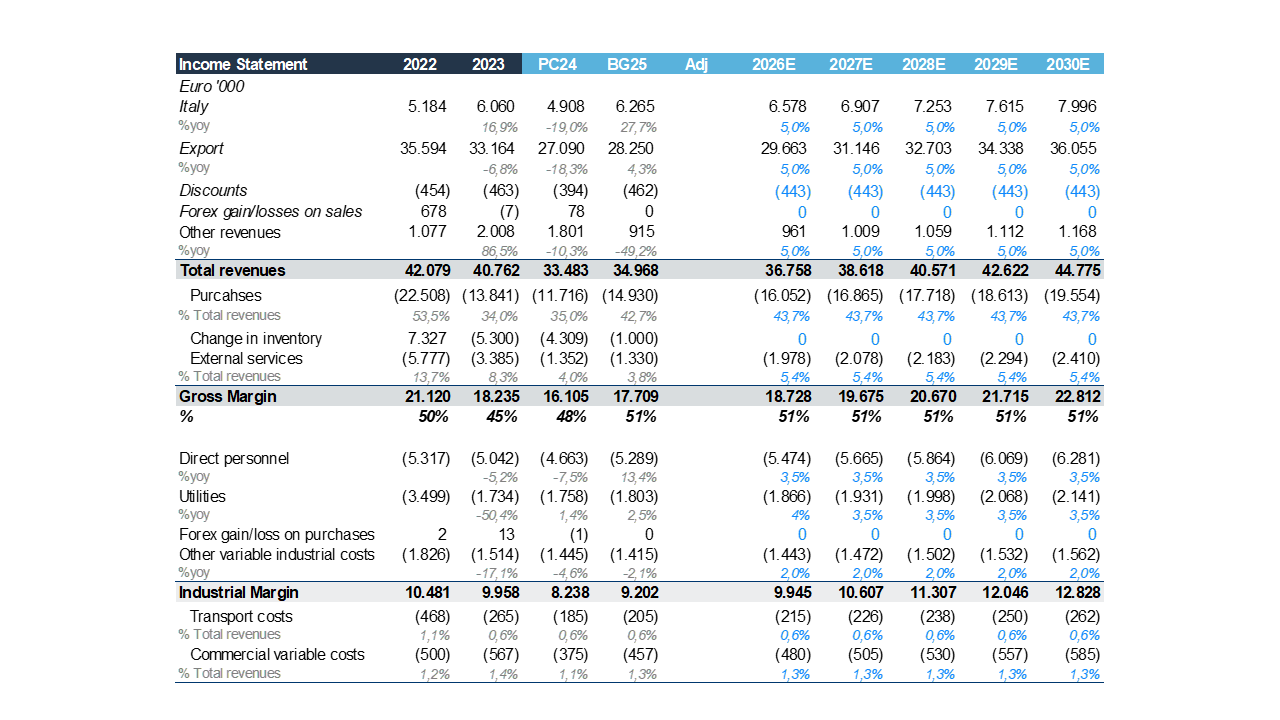

Financial technicals

Calculation of the price

Enterprise Value

Multiples (EBITDA, ARR, P/E)

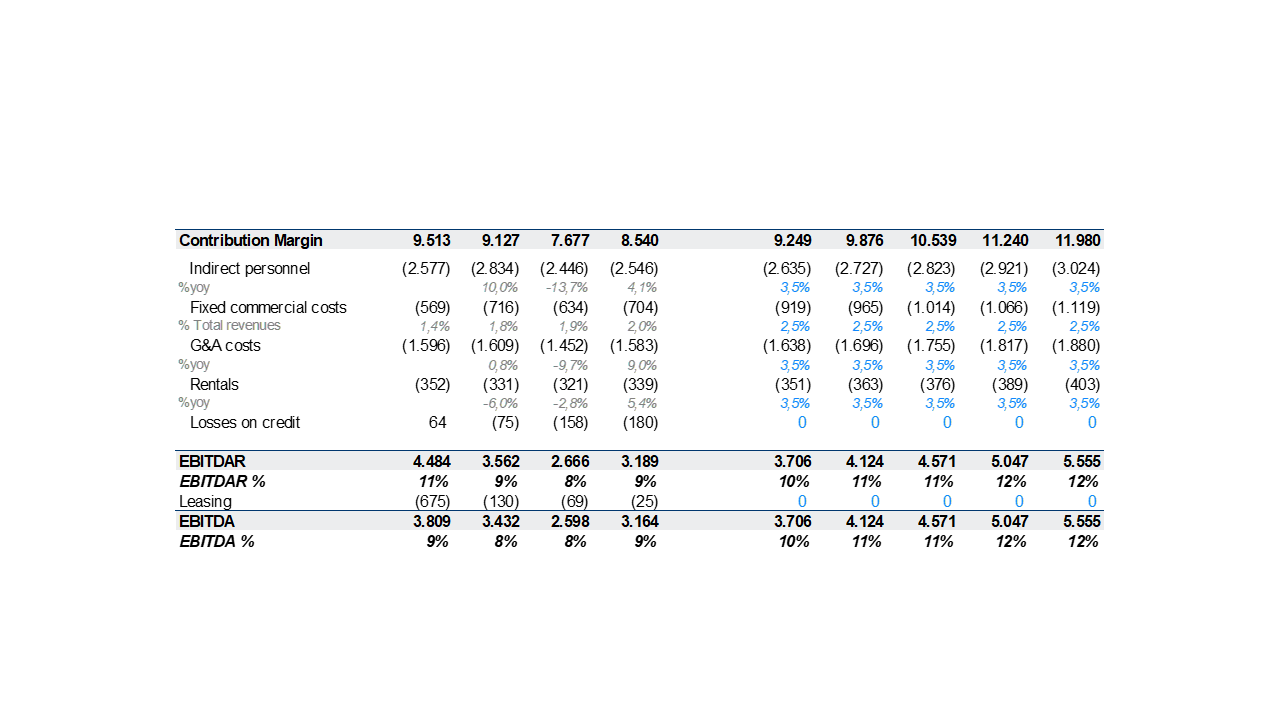

EBITDA and EBITDA Adjusted

Net financial position, with focus on working capital

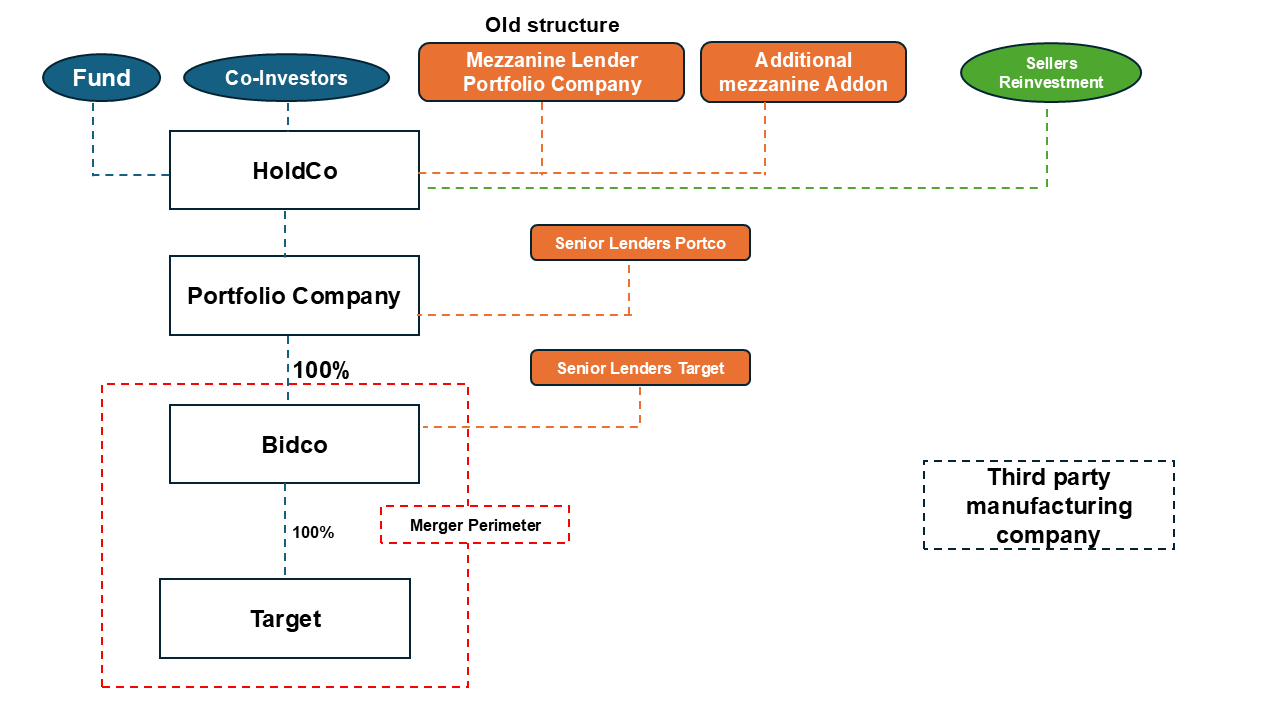

Deal structure

LBO Model

LBO Structure

Sources

Equity

Reinvestment

Ratchet and earn-out

Types of debt (junior and senior)

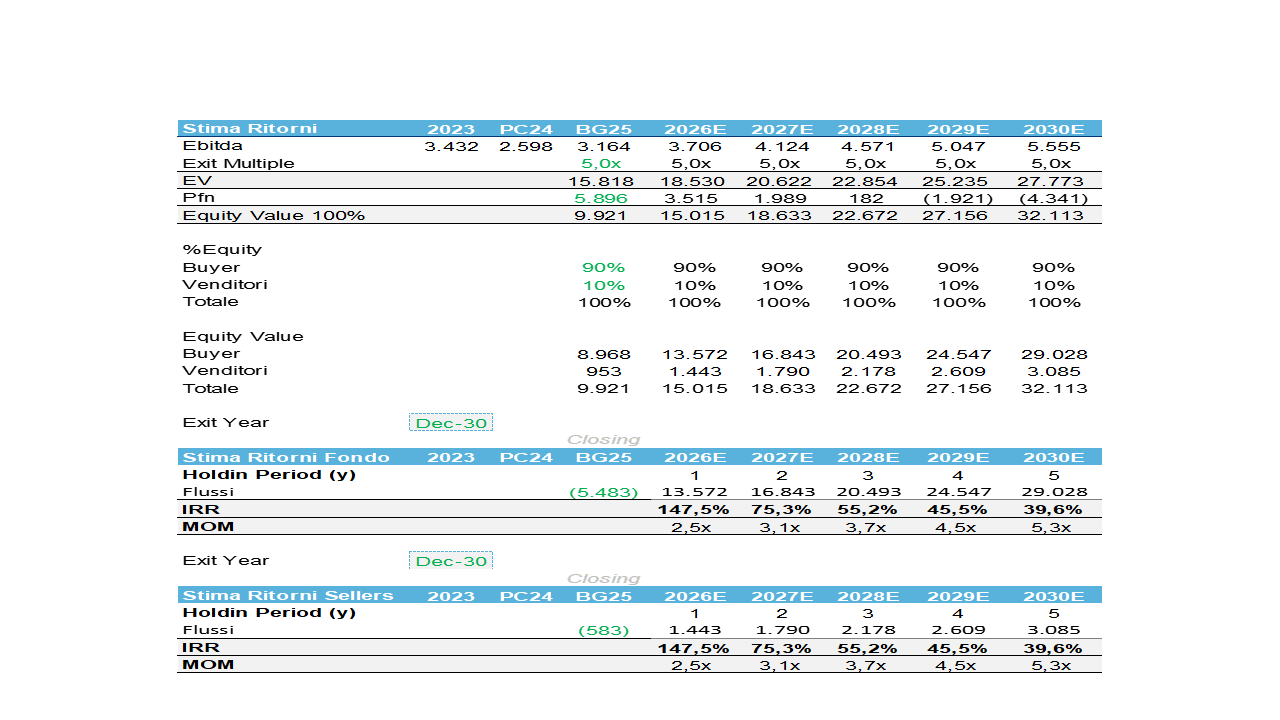

Exit analysis

Multiple arbitrage

IRR

Cash-On-Cash

Lesson 2

Deal structuring

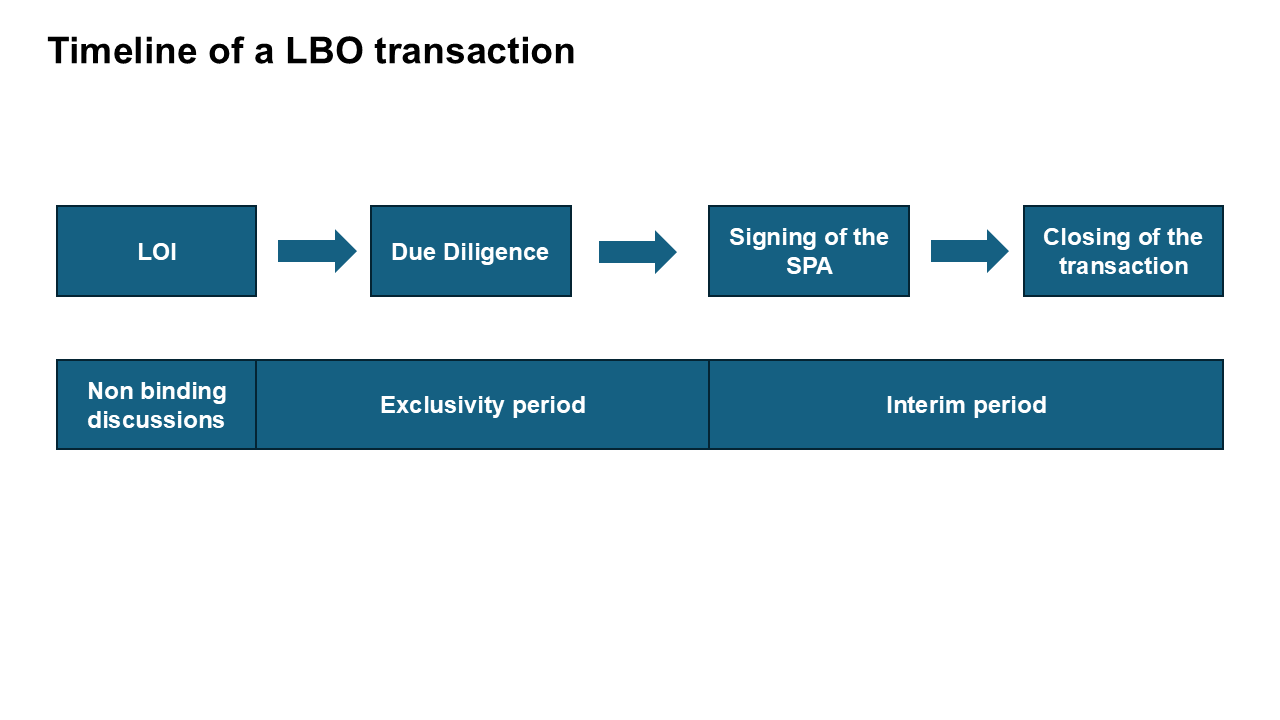

Timeline of a LBO

How to draft a LOI

Content of the SPA

Locked Box vs Closing Accounts

Representations and Warrantis

Conditions Precedent

Interim Period Obligations

Non-Competition Obligations

Sole remedy clauses

Qualitativa Limitations to the liabiltiies (from breach of R&W)

Quantitative limitations

Closing Date

Escrow and First-Demanad Guarantee

Lesson 3

Reading the DD Reports

Commercial Due Diligence

Five forces analysis and 5 C’s:

Barriers to entry

Supplier’s power

Buyer’s power

Competitive rivalry

Threat of substitutes and products

Customers

Collaborators

Competitors

Context

Company

Financial Due Diligence

Legal and Tax Due Diligence